When we think of millionaires, we picture highly successful lawyers, bankers, doctors or businessmen. People driving fancy cars and having an expensive lifestyle. Earning millions in order to become a millionaire.

But the truth is that you don’t need to earn six figures income or more in order to get into the millionaire club. With proper planning and discipline, an average Joe with an average income can become wealthy in the US without winning the lottery or getting a fat inheritance.

How much does the average Joe earn?

According to the US Census, the median household income in the country was $59,039 in 2016. Growing a nest egg of more than a million dollars may seem impossible on this sort of a salary, but it is very much doable, if you have the discipline and spend less than you earn.

Figure out what is important for you – Many of the people make their millions by becoming successful in business or rising up the corporate ladder, but a vast majority of the people grow their nest eggs by plain old fashioned hard work, living below their means, staying out of debt and start saving early in their career. As simple as that. You don’t need to be a wizard in picking winning stocks or have astute knowledge of the inner workings of the stock market or the macro and micro economic trends in the global economy. Leave that macro economic BS for the experts. They need to justify their fat packets.

How much do you need to save?

At the bare minimum at least 10% of the income should be saved irrespective of how much you earn. Increasing the savings rate to 25% or more will significantly reduce the number of years required to reach your goal, but lets stay with 10% for now. If your income falls within the median annual household income of $59,039, you will have to save $5900 per year @ 10% of median household income in 2016.

If you have a 401 K then you should contribute this much or more in pre tax dollars. However many of the workers may not have an employer sponsored 401K option for tax advantaged savings and hence have to invest in an IRA. The current IRA contribution limit for workers under 50 is $6,000 (Up from $5,500 in 2018), income limits apply. If you are over 50, then you can save another $1,000 in your IRA as catch up contribution.

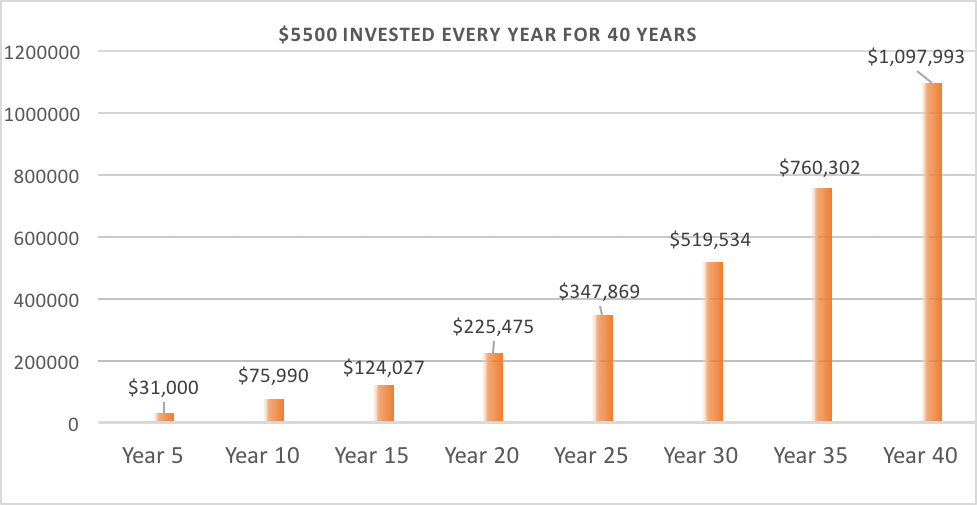

If you earn median salary and contribute $5,500 of it to an IRA each year, you will come close to that ideal 10% savings target. Let’s assume you start saving $5,500 a year, or roughly $458 a month, early on in your career, starting at age 27 – and you continue doing so until age 67 – what the Social Security Administration considers full retirement age for anyone born in 1960 or later, your investment would have grown to a princely sum of over $ 1 Million, Yes!

Let’s also assume that you invest that money in a low cost index fund and gain a average annual 7% return over 40 years. Because IRAs offer tax-deferred growth, you won’t pay taxes on your earnings until you reach retirement, which means you get to reinvest your total gains year after year. So if we take that $5500 annual investment and apply it every year, over a 40-year term, this small investment of yours will grow into a grand total of $1 million @ 7% annual returns.

But why 7% ?

Since its inception in 1928, the S&P 500 has returned about 10% per year. Adjusting for inflation the “real return” is more like 7 %.

So fifth grade math and historical data tells us that a million is within reach of anyone in the US with an average income and average investing skills with a savings rate of less than 10% , due to the long term growth in value delivered by US corporations and the magic of compounding. Compounding is the concept of earning interest on interest. The reason so many financial experts urge people to start saving early on in their careers is that doing so allows them to take the most advantage of compounding.

The age at which you first start saving will impact your total nest egg. Assuming a monthly contribution of $458 and an average yearly 7% return, If you start saving ten years later, at age 37 you will end up with only half the amount – 555 K !!! at your retirement. On the other hand if you can start early and increase your savings percentage to 20% or more , then you can reach your magic number much before retirement age.

For more stories on savings and investment read Trade wars and falling markets. Should I move into bonds.

If you are aiming to achieve financial independence and travel the world send us a note and we will send you a FREE booklet on “How much do you need to achieve Financial Independence.”

Wonder advice! I have heard the principal before, but never have a read such a clear explanation.

Thank you

Thanks Bob,appreciate your comments.