Compound interest is the eighth wonder in the world. He who understands it, earns it … he who doesn’t … pays it. This profound wisdom on compound interest being the most powerful force in the universe is attributed to none other than Albert Einstein. I am infinitely motivated by this quote and strongly believe that basic financial literacy should be the requirement for every graduating college student. It will save millions of people from financial harakiri and needless agony, misery and finally bankruptcy . It is never too late. For those trying to play catch up. Start today! The magic of compounding – needs the fairy dust of time.

Compound interest happens when interest which accrues on an account accrues interest itself . For instance, if $100 is invested in the S&P 500 and it gains 10 percent in a year, that will generate $110, after another year it’s $121 and after a third year it’s $133. All the investment vehicles including workplace retirement accounts, IRA’s, 529 college savings accounts are not just saving account but they are actively reinvested and benefit from the power of compounding.

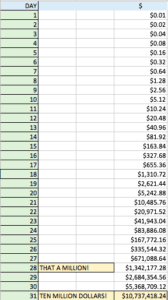

While reading about the power of compounding I came across an article by Barbara Friedberg in her article in goodfinancialcents why you should start investing now. Even though I have been a believer in compounding, this amazing article jolted me . She illustrates a chart to show the power of compounding – it shows the value of 1 penny becoming $10 Million after 31 days – if the value doubles every day. No that is not a typo , you read it right – $10 Million. I was skeptical and decided to fire up my spreadsheet and see the result for myself.

A penny to $10 Million. The magic of compounding.

Time in the markets is more important than the investment returns. The earlier you start investing, the larger your gains will be. If graduate entering the workforce at 22 years of age, invests $10,000 in the S&P 500 and doesn’t save a dime after that, this initial investment will grow to $450,000 by the time he is ready to retire in 40 years – assuming the dividends are reinvested and allowed to compound and index will deliver the same return of around 10% per year which it has delivered for the last 40 years.

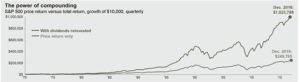

The magic of Compounding

The chart below from JP Morgan which shows the power of compound interest.

$ 10,000 initial investment in S&P 500 in 1970 , would have returned $250,000

If dividend payments are reinvested and allowed to compound the same $10,000 would be worth more than a million dollars!

Even if you are already in your 30s or 40s or 50’s, it is never too late to start saving for your retirement, but the younger you are when you start, the more you stand to benefit and the less money you need to put away each month compared with somebody starting to save in later years. It’s all about allowing time for your money to grow. Take heart if you are starting late – Automate your savings and pay your self first, you will find a way to manage in the available resources.

Dont bank on retiring early by cutting out the latte. Think Big. Tackle the big expenses , housing , transportation and food are the big three in that order. Cutting out coffee will save you $4 but refinancing your home or moving home closer to work can save you hundreds or even thousands. Spend ten minutes and shop around for a better insurance quote. Studies have shown that customers who stay with the same insurance provider pay more over time.

Contribute to your 401K. money comes out of your paycheck pretax, which means that for every $1000 you will save $150 if you are at the 15% tax slab. If you eat out everyday, try packing a lunch from home for a couple of days. You will probably eat healthier as well. In the long term it will also be cheaper to be healthier.

If you are aiming to achieve financial independence and travel the world send us a note and we will send you a FREE booklet on “How much do you need to achieve Financial Independence.”