At the age of 26, four months after my marriage , I made my first investment. We bought a parcel of land on which I was to later build a single family home. Paying the monthly mortgage out of our starting salaries was a stretch , and we had to manage with what was left over after paying the bank. We were living with my parents at that time, so our monthly expenses were limited to transportation costs, branded clothes and eating out – which was almost every day. We could have easily blown the entire paycheck with our lifestyle creep, but this initial investment forced us to live within a limited budget and was to pay rich dividends later. Lesson here being – “Spend what is left after saving”

Where should I invest?

Investing in stocks or bonds and investing in real estate are the top choices for building long term assets. Stocks give you fractional ownership in an corporation . Over long term if the company performs well, there is Increase in the net worth of the company and hence the increase in price of individual stocks of the company. Many companies also pay out dividend, which is a portion of the profits returned to the shareholders.

Bonds, on the other hand, represent debt. A government, corporation, or other entity that needs to raise cash, borrows money in the public market and subsequently pays interest on that loan to investors. The rates of return are low but for investors who prefer to invest in less risky instruments, Bonds are the way to go. The value of the stocks can go down if the company performs poorly, but bonds have a pre determined returns and have low risk. US treasury bonds are among the safest investments across the globe.

Real estate investment returns don’t conform to a predictable model. Location, demography, economy, infrastructure and other variables affect the return on investment from real estate. Historically house prices in the US have increased only slightly more than the level of inflation except for the period between 1990 and 2006. However investment in real estate with a positive cash flow can be a effective strategy to build passive income stream.

Over the long term, stocks perform significantly better. Since 1926, large stocks have returned an average of 10 % per year and long-term government bonds have returned between 5% and 6%. However, the 5-year return for bond index had now dropped down to 2%, after its peak at around 6.5% back in 2012. Bonds may help you sleep well, but at current rates, you will hardly recover the money lost to inflation.

What portion of my savings should be invested in stocks?

Conventional wisdom and advice dished out by financial planners and experts recommend a age dependent ratio of investments across stocks and bonds. The commonly suggested ratio is (100-age) for stocks and the rest for bonds, so a 30 year old should invest 70% of his funds in stocks and rest in bonds, whereas a 60 year old should invest 40% of his funds is stocks and rest in bonds.

I do see merit in this model if one is few years away from the official retirement age of 62 and cannot handle the volatility of the stock market, or faces a prolonged bear market which starts just after retirement, however for most other cases I believe that this model is inefficient for your financial health and can result in investors having to delay their retirement by few years.

Investment allocations among stocks and bonds are based on personal goals, target age of retirement, risk appetite and hence cannot confirm to a standard model. Investors planning for early financial independence are looking at 30 or more years in retirement and a higher bond allocation will significantly reduce the overall returns and impact portfolio growth. There has been a lot of research done on efficient asset allocation strategies there are various models for glide path.

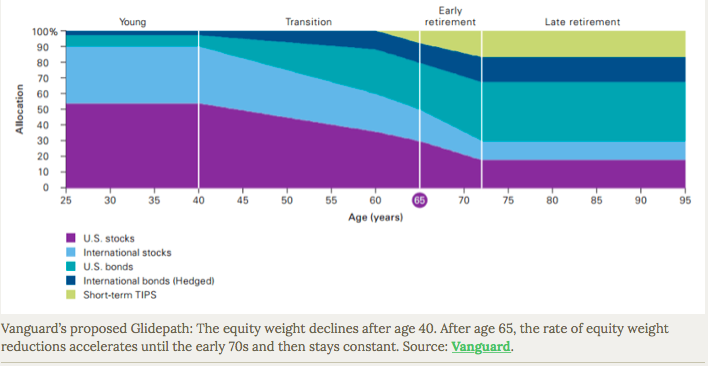

Glide path? In the investment world, the term glide path refers to the asset allocation model for a target date fund or a retirement fund. Investments are allocated among risky assets such as stocks and low risk assets such as bonds in a pre determined model. The glide path for target funds shifts from high risk equity allocations in the beginning to gradually increasing fixed income assets as the target date approaches.

See Vanguard’s proposed glide path for its target date ( a k a retirement) fund. From age 40, the equity portion of the portfolio starts declining till the retirement age of 72 and then stays constant at 30% of the total portfolio.

But recent research suggests that Vanguard and other may have got the model wrong, or in other words the glidepath should actually start to increase as retirement nears and continue to increase beyond retirement.

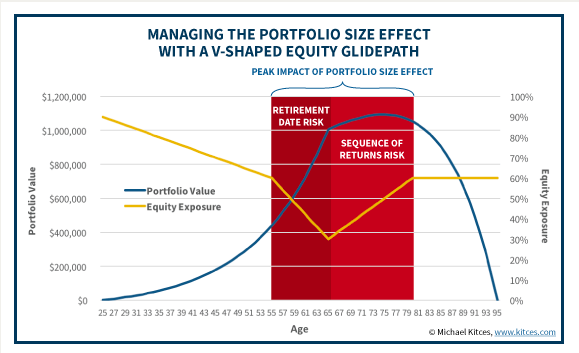

Michael Kitces did a research on this and proposed a V shaped Glide path, starting with high equity exposure in the initial working years, reducing as the retirement approaches and then builds up again during the first decade of retirement. In other words the retiree builds a bond reserve in the final decade leading up to retirement and then spends down that bond reserve during the initial years of retirement, helping his equity exposure to catch up or grow. You can read further details on his Blog here.

Michael Kitces proposed V shade glide path – source : Kitces.com

Notice in the chart above the equity allocation graph makes a V shape, sharply decreasing in the last decade before retirement and then keeps rising for the next decade and half after the retirement age of 65.

For people seeking early financial independence, there will be a long runway of three or more decades for the portfolio to recover from extreme volatility. If the planned annual withdrawal is the standard 3 to 4% of the total portfolio value, there is more than 95% success rate over a 30 year period or more. In other words, the chances of running out of money during your long retirement of 30 years or more is highly unlikely for various models with a equity weight of over 60%. cFIREsim is a great resource to model market returns under different conditions

But we have been riding on a long bull market. What if the modeling is wrong?

Modeling tools use historical data and attempt to model future returns. They are meant to provide a broad framework as no one has seen the future. What if there is a global viral epidemic which wipes out one fifth of the human population, or a nuclear war? In which case stock market returns will be the least of the worry! Don’t sweat the details, stick to the basics. If you are consistently saving a portion of your income and living within your means, your portfolio will turn out just great in the long term. If a US resident consistently saves just 10% of the average annual salary of $59K, and invests in a low cost index fund, he would accumulate a sum of $1.25 million by age 65.

Despite what the financial pundits and experts would like you to believe, no one can predict the course of the markets. Markets are going to crash and there could be major downturns every decade. Major downturn would be one wherein the markets would crash 20% or more. What is important to understand is that the drop in value is notional and the markets will find their original levels, sooner than you think.

In the past most of the bear market drops have recovered within 18 to 24 months, barring the major market crashes like the 2008 market crash which took around 6 years to retrace its high level before the crash. Six years will pass in a breeze when you have multiple decades of financially independent life ahead of you.

Is it not risky to be fully invested in stocks?

Yes of course, stocks can crash and will crash multiple times in your investment lifetime. What percentage of your investment should be in stocks is a very personal decision. Pick a allocation strategy which lets you sleep peacefully at night. If you cannot bear seeing your portfolio value drop by 20% or more, then being 100% invested in stocks may not be the right strategy for you. Have an appropriate percentage in bonds or other assets which minimizes your risk perception and helps you mentally weather the volatility of the market.

However, I am of the opinion that every dollar not in stocks is an opportunity lost, especially when you have few decades or more for your investment to grew. Between 1928 and 2018, the S&P 500 had an average annual return of close to 10 percent. Few assets classes have delivered this sort of return for so long. Lets follow Bob and Tom as they follow two investment styles.

Bob is 30 years old and plans to retire at 65. That gives him 35 years to prepare for retirement. If he invest $10,000 per year, and earns an average of 10 percent annually, he will have more than $2.7 million by the time he reaches 65.

By contrast, Bob’s friend Tom is worried about the market downturns and decides to invest 50 percent of his annual contribution in bonds, with an average rate of return of two percent. At the end of 35 years, Tom will have $1.35 million in his stock portfolio, and only about $250,000 in his bond portfolio. The total would be $1.6 million.

By investing 100 percent of his money in stocks, Bob comes out ahead by $1.1 million—$2.7 million versus $1.6 million.

What’s your investment strategy?

For more stories on financial independence read How much money do the wealthy in US have.